Strategic Planning: Cutting Costs is Not a Substitute for Growth

The whispers of another recession looming on the horizon has many small- and medium-sized businesses running straight to the chopping block with their operating costs, administrative costs, and other expenses in tow. But here’s the hard truth: while, yes, an economic downturn may require a hard look at eliminating waste and cost cutting initiatives — it is absolutely not an excuse to let go of your strategic planning initiatives and growth efforts.

According to Business Insider, the US is not technically in a recession, however, we could potentially be in one soon. For those of us who experienced the Great Recession (2007 – 2009) and lived to tell the tale, you know business life ain’t easy! You have to “put your nose to the grindstone”, “pull yourself up by your bootstraps”, or “pull up your big girl undies” (or any other useful idiom) and figure out your new path to success. Because as my Dad used to say… “shit happens” and “life ain’t fair”. Plan and move anyway!

The calm before the storm in a recession typically involves a period of tremendous uncertainty followed by a drop in sales. Understandably, your customers will essentially be buying less goods and services, be unwilling to sign long-term contracts and more likely to cancel existing orders. To sum it all up, “lower incomes for households equals lower profits for businesses“.

Cost reduction and future growth planning are not an either/or scenario, and while certain periods of time may require a bit more emphasis on one area or another, as a business owner you need to keep both your cost cutting strategy and your future growth planning (both long term and short term) at the top of the list. As an article by Forbes magazine states, “Over-cutting risks crippling the company’s ability to grow in the future, while hesitancy to cut costs puts the survival of the company at risk.”

Now that we know what to look for and what questions to ask ourselves, how do we actually prepare our businesses to survive?

Recession Proofing Takeaways

Create a strategy to weather the storm (recessions don’t last forever). According to an article written by Daniel Altman in Entreprenuer.com, the important thing for owners and managers to focus on is deciding what a recession means to you. Ask yourself the following:

- What does a deep and sustained decline in your business look like?

- Can you prepare for it and if so, how?

- How does your strategy adjust until the recession is over?

- How do you seize opportunities after it ends?

Stay connected to your Customers. During tough economic times, customer retention is crucial. It’s not enough to just rely on your product or service to keep customers coming back. It takes creative thinking and teamwork to find new and innovative ways to keep customers engaged and loyal. Here are some tips: check in with your customers regularly, showcase different uses of your product or service, and you may even want to offer extended free trials to entice customers.

A cost cutting measure should never include the budget you’ve devoted towards supporting and interacting with your customers. In fact, staying close to your customer base may even be more important during a recession. Why? You’ll need to understand their changing needs and desires, and you’ll need the ability to flex in response. Use this opportunity to get to know your clientele on a deeper level, not only to preserve revenue but to give yourself an edge in the market.

Keep investing in marketing (don’t cut costs). In 2009, at the height of The Great Recession, HBR identified patterns in consumers’ behavior and business strategies when studying the marketing successes and failures of companies throughout economic downturns from the 1970s onward. While this data is outdated, there are some great takeaways that still apply today, including:

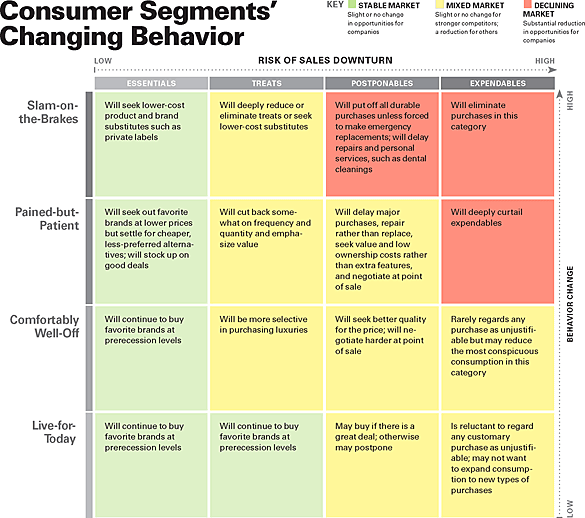

- Ignore the typical segmentation by demographics or lifestyle, instead focus on psychological segmentation (emotional reactions as it relates to buying).

- “To buy or not to buy” is categorized in four groups: essentials, treats, postponables, and expendables. Which category do your products and services fall into?

Tailor your marketing tactics to your segments (seize new opportunities). There are a multitude of ways that you can adjust your existing marketing tactics to better suit the new “recession buyer”. Once you understand the new or maybe slightly altered motivations of your buyers you can create opportunities to meet your buyers where they are. For example, simplify your product or service portfolio, consider improving the affordability of your products and services (just don’t improve it so much that you devalue them), and lastly, be honest and create more trust with your buyers.

Identify your total costs (e.g. labor costs, business travel, any and all technology investment, digital resources, and additional spending). Having a holistic financial picture is a non-negotiable no matter what the global fiscal climate is doing. Understanding exactly where your money is going can help you quickly lower costs when needed. Additionally, be very clear about the critical spending versus the unnecessary spending.

When times are good, there’s nothing wrong with spending a little extra on the “nice-to-haves” when the budget allows for it. But in order to recession proof your business, it’s extremely important to know what’s critical to your productive capacity (e.g. office space vs. remote working) and what’s not (extra or unused subscriptions or licenses, initiatives to replace technology that’s still functional and safe, etc.)

Do more with less. With the uncertainty of the current economy, businesses will have to find creative ways to ensure future growth. Fortunately, the latest AI technologies can offer an organized approach to future-focused strategies. AI tools can analyze data faster than humanly possible and provide timely insights that steer strategy toward growth opportunities – identifying potential customers and pinpointing target audiences for marketing campaigns in seconds. Something to note, however, is that while AI can be a tool to help keep you one step ahead of the game despite economic hardships, AI is only as good as the humans who use it.

Consider Additional Revenue Streams

Another key way to recession-proof your business is to coordinate multiple revenue streams. The more productive capacity you can muster, the better off you’ll be… this is just another way to remain agile and to provide value in a multitude of ways. You may also consider offering different tiers of products at different price points to maintain your income, regardless of the economy.

Focus on your Team

While it may seem like times of economic downturn may require all your energy to go towards cost cutting measures, this is where you’ll need to to make sure you maintain efforts to improve performance.

Really, it’s your team that’s going to help you weather the storm, along with their ability to help your business remain as flexible and creative as possible. While you’ll need to keep your budget in mind, use this time to build skills, cross-train your staff, and focus attention on employee development.

This is especially critical if many of your staff members work remotely. Keeping morale high for your employees will help make sure they reach their full potential and that productivity remains high… even in the toughest of times.

Model Your Strategic Approach

HubSpot wrote a great article on recession proofing your business last fall and included a quick list of recession-proof business ideas for those who are looking at starting something new. Check out the list here and take a look at our takeaways below:

There’s a few known “recession-proof” industries which include:

- Healthcare

- Accounting and financial services

- Home and auto repair

- Fast food

- Online education

- Baby products

Obviously, there are certain intrinsic elements, or built-in benefits of these industries, that help safeguard them from the trials and tribulations of economic fluctuation. One strategy which may help protect your investments as a small business to consider what areas, features, or similarities you may share with one or more of these industries and how you can use those qualities to your advantage.

In Conclusion…

Unfortunately, ebbs and flows in the market are unavoidable, but when you have a good financial plan in place, and continue to prioritize the long and short-term growth of your company, it’s much easier to weather the storm.